Since the 2015 creation of the Task Force on Climate-Related Financial Disclosures (TCFD), business leaders have begun to understand climate change as a material financial risk and a growing threat that requires rapid and decisive action. Climate disasters, stakeholder activism, public pressure, and regulatory changes are showing managers and executives that they must integrate sustainability throughout all levels of their organizations.

Company organizational structures and allocations of authority and accountability play a crucial role in how a company and its leaders respond to climate and broader ESG concerns. Effective practices in Corporate Governance – the systems of rules, practices, and processes determining how a company is directed and managed – have been proven to improve public faith and confidence in times of crisis and at flash points in social and environmental movements.

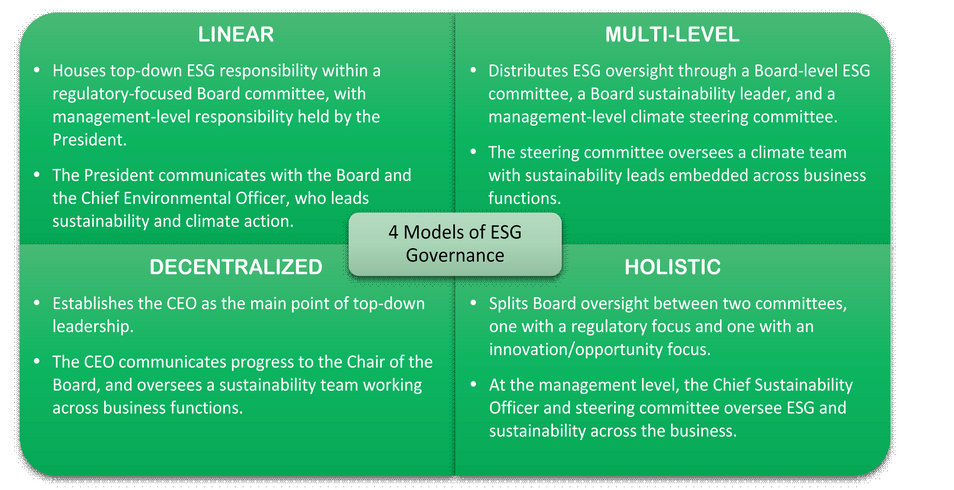

The Climate Board did a round-up of different models for governance and oversight of ESG. We surveyed the practices and structures of companies known for strong corporate governance, ambitious sustainability programs, and bold climate action. Crucially, we found that governance structures were not uniform across these leaders – structures were tailored to the industry, history, and capabilities of each organization, but all achieve the same objective of strong ESG and climate performance.

Some companies used an ESG-focused Board committee to drive top-down action, while others leveraged the power of Presidents and CEOs to affect change. One company leveraged a steering committee of leaders across its global business functions to ensure that accountability for ESG performance was spread throughout all divisions of the organization. Many introduced remuneration policies tying performance on ESG goals to executive and manager compensation.

Within the hard-to-abate infrastructure space, governance can play an especially crucial role in effective climate action. Given the long lifespans of infrastructure projects and strict performance requirements around durability and safety, the long-term horizons of Board decision-making can ease tensions between immediate profits and investment in sustainability.

An example of ESG-minded governance practices within the infrastructure space comes from Jacobs. As a component of their PlanBeyond climate action plan, they made extensive changes to their governance practices to help formalize accountability and advance their climate and decarbonization goals. As a part of their focus on sustainability, they introduced a standing ESG & Risk Committee to their Board. They developed a climate steering committee of executives across business functions to ensure diverse perspectives within the decision-making and oversight around their climate action. Throughout the organization, they’ve embedded Sustainability Leads to drive continued progress on climate and ESG goals.

Our research has shown that while governance practices play an important role in a company’s approach and progress on climate action, changes to corporate governance must be custom fit to each organization’s goals, structure, and culture. Other models in addition to these four have proven effective – each has its own advantages and risks.

To access our research, including more in-depth reviews of these and other governance structures, the advantages and risks of each, and profiles of organizations that have deployed them effectively to drive climate action, contact us info@theclimateboard.com.

Subscribe to our mailing list to be notified when we post new content.